Associated Press

- Sweden's top central banker said bitcoin trading was like dealing in stamps and suggested that it could crash.

- Ingves's comments are broadly in line with what other central bankers have said about bitcoin and crypto.

- In February, Ireland's central bank governor Gabriel Makhlouf said bitcoin investors should be ready to lose all their money.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

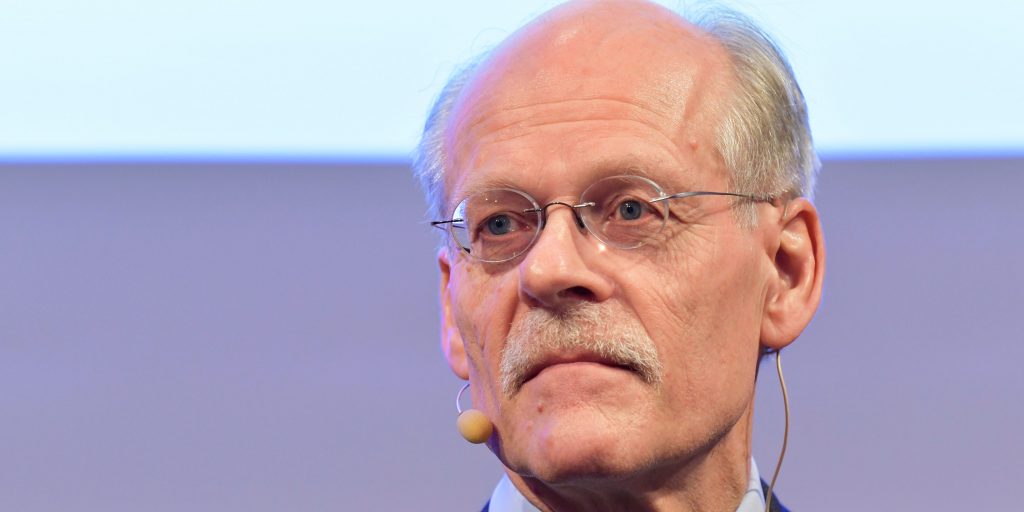

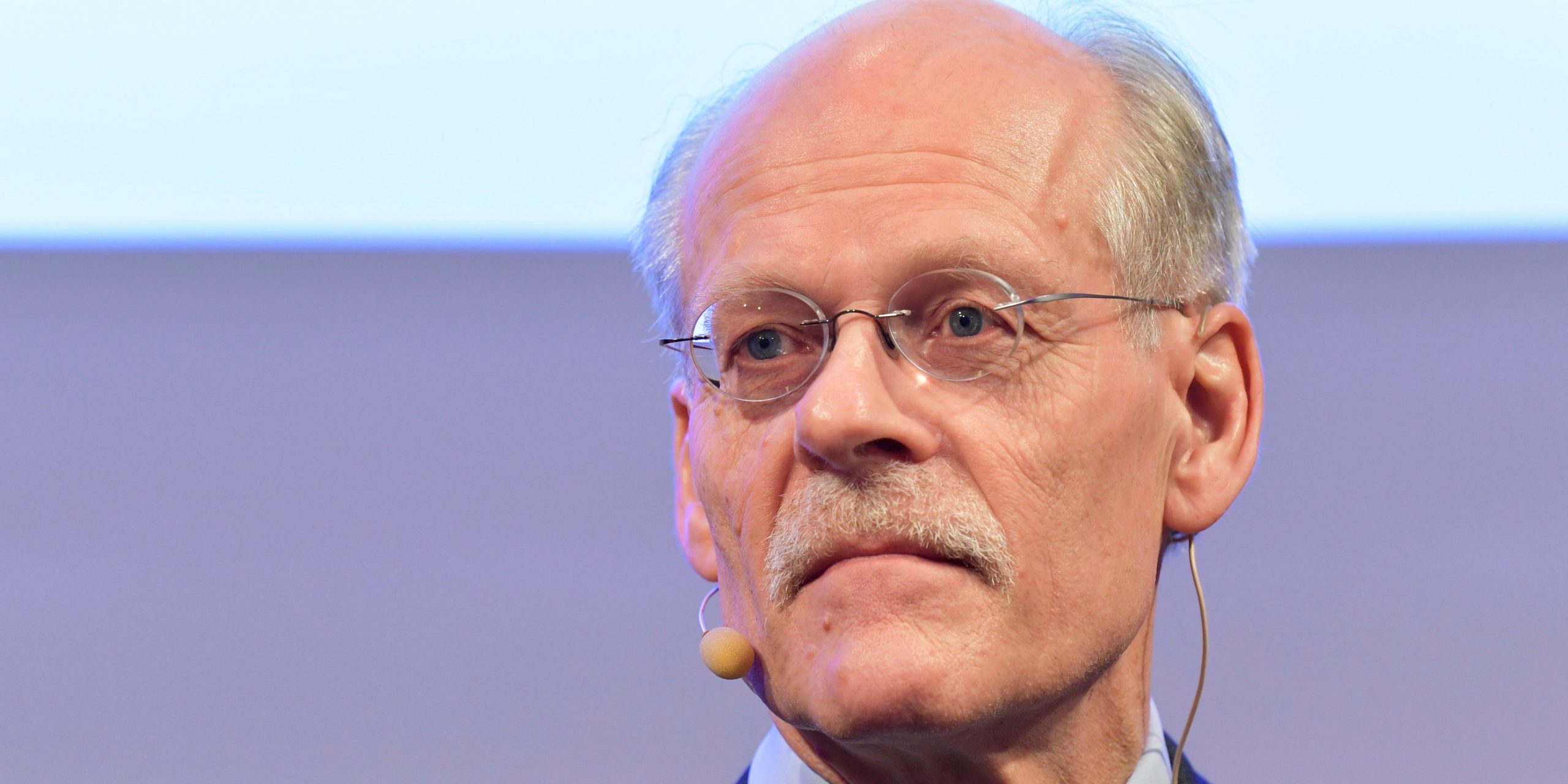

Sweden's top central banker said bitcoin trading was like dealing in stamps and suggested that non-official money will eventually fail one way or another, according to a report from Bloomberg.

"Private money usually collapses sooner or later," Riksbank Governor Stefan Ingves said at a Swedish banking conference. "And sure, you can get rich by trading in bitcoin, but it's comparable to trading in stamps."

Ingves's comments are broadly in line with what other central bankers have said about bitcoin and crypto. In February, Ireland's central bank governor Gabriel Makhlouf said bitcoin investors should be ready to lose all their money.

"Personally, I wouldn't put my money into it, but clearly, some people think it's a good bet," Makhlouf said. "Three hundred years ago, people put money into tulips because they thought it was an investment."

Likewise, in May, Bank of England governor Andrew Bailey said cryptocurrencies have no intrinsic value and may crash to zero.

"I'm sorry, I'm going to say this very bluntly again: buy them only if you're prepared to lose all your money," Bailey said as dogecoin was surging to new heights.

Central banks across the world are looking into developing their own virtual money, known as central bank digital currencies. After some halting attempts in places like Venezuela and the Marshall Islands to launch CBDCs, the Bahamas was the first to successfully do so nationwide last year.

The Federal Reserve has said it is researching the pros and cons of creating a CBDC for America, which some have called FedCoin.